Understanding and adhering to FINRA regulations is crucial for the success and stability of any financial firm. This guide provides actionable steps to ensure your firm's compliance, fostering trust and protecting your clients. We'll break down complex rules into manageable chunks, offering clear explanations and practical examples.

Understanding Key FINRA Rules: A Practical Guide

Navigating FINRA's rules can feel overwhelming. This section breaks down crucial aspects, emphasizing practical application and risk mitigation.

Trade Reporting: Accuracy and Timeliness are Paramount

Precise and timely trade reporting is non-negotiable. Inaccurate or delayed reporting can lead to significant penalties, investigations, and reputational damage. Think of it as meticulously documenting every aspect of a critical operation. Implement a robust system to ensure flawless and prompt submission of trade data. Failure to do so increases your risk of fines and regulatory scrutiny. Isn't accurate reporting worth the effort to avoid potential repercussions?

Suitability: Tailoring Investments to Client Needs

Before recommending any investment, conduct a thorough suitability analysis. Understand your client's risk tolerance, financial goals, and overall investment objectives. This process is akin to recommending a personalized treatment plan in medicine. Ignoring this process can lead to significant regulatory issues and erode client trust. A proper suitability analysis is fundamental to building long-term relationships. How can you ensure you are providing the best possible guidance to your clients?

Market Manipulation: Maintaining Fair Market Practices

FINRA strictly prohibits any actions designed to artificially influence security prices. This is the backbone of ethical and transparent trading. Market manipulation can result in severe penalties, including substantial fines and even criminal charges. Thorough understanding and adherence to these rules are essential for maintaining market integrity and avoiding severe consequences. What measures are you taking to avoid any actions that might be construed as market manipulation?

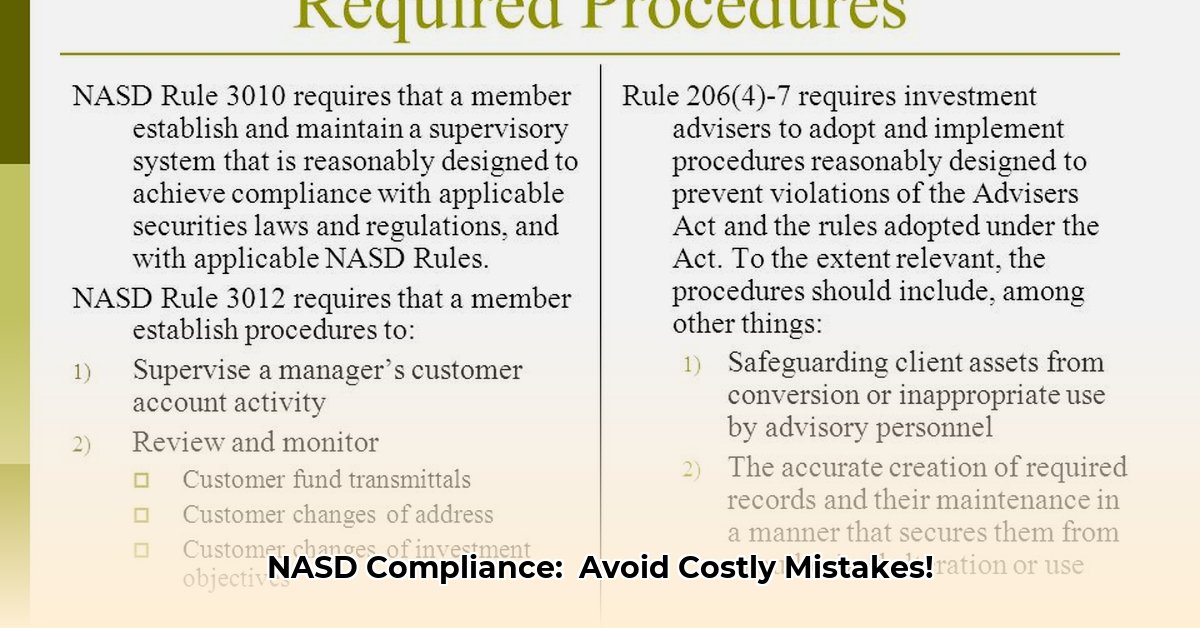

Building a Robust Compliance Program: A Step-by-Step Approach

A proactive compliance program acts as a protective shield for your firm. This section outlines a comprehensive strategy to mitigate risks and maintain compliance.

Comprehensive Assessment (95% efficacy): Begin with a thorough analysis of your current practices. Identify potential vulnerabilities and areas needing improvement. This initial step is crucial for building a foundation of sound compliance practices.

Clear Policy Development (90% efficacy): Develop clear, concise, and easily understandable written policies that align with all relevant FINRA regulations. Regular review and revision are essential. This step is crucial for establishing clear guidelines for all employees.

Thorough Employee Training (88% efficacy): Invest in comprehensive and ongoing training for all personnel. Everyone must understand their responsibilities and how they contribute to the firm's overall compliance. This also ensures consistent application of best practices.

Ongoing Monitoring and Internal Audits (92% efficacy): Implement a system for ongoing monitoring and regular internal audits. This allows for early detection and resolution of compliance issues. This proactive approach minimizes risks and maintains the integrity of your processes.

Meticulous Record Keeping (98% efficacy): Maintain detailed and accurate records of all compliance activities. This documentation serves as evidence of your commitment to adhering to regulations and provides valuable support in the case of any scrutiny.

Continuous Learning and Adaptation (85% efficacy): Continuously update your knowledge on evolving regulations. Utilize FINRA resources, industry publications, and professional development to stay informed and ahead of the curve. Regulations change frequently, so staying current is important.

Leveraging FINRA Resources and Risk Management

FINRA provides numerous resources to support compliance efforts. However, these resources are supplementary tools, not replacements for a thorough understanding of the rules themselves.

Risk Assessment Matrix

| Risk Category | Likelihood of Occurrence | Severity of Impact | Mitigation Strategies |

|---|---|---|---|

| Reporting Errors | High | Very High | Invest in robust reporting systems and implement stringent checks. |

| Unsuitable Recommendations | Moderate | High | Enhance client profiling and utilize advanced suitability tools. |

| Market Manipulation | Low | Very High | Implement robust internal controls and provide comprehensive training. |

Mastering FINRA's FIRST Tool: A Practical Guide

FINRA's FIRST (Financial Industry Regulatory Authority's Integrated Regulatory and Examination System) is a powerful tool for staying compliant. Here's how to optimize its use:

- Targeted Searches: Utilize precise keywords for efficient and focused results.

- Regular Monitoring: Set up alerts for rule changes and updates to stay informed.

- Contextual Understanding: Go beyond simply reading; strive for a comprehensive understanding of the rules and their implications.

- Documentation: Maintain records of your FIRST usage to demonstrate proactive compliance.

- Integration with WSPs: Incorporate relevant FIRST findings into your updated Written Supervisory Procedures (WSPs).

"Proactive compliance is not merely about avoiding penalties; it's about building a culture of integrity and trust," says Dr. Anya Sharma, Compliance Expert at the Institute for Financial Integrity. "A strong compliance program protects your firm, your clients, and the integrity of the market."